Answer: If you end the year earning more than you estimated you may have to pay back some or all of the premium tax credits you received.If your income increases during the year and you end up earning more than you originally thought when you applied for your insurance , you may have to pay back some or all of the Tax Credit Payments that lowered your monthly premiums over the year.

NOTE: This page covers Advanced Premium Tax Credit Repayment limits for 2018 under the Affordable Care Act (needed for filing for taxes filed April 2019). Those are the same limits as 2017. We will update this page each year.

How much has to be paid back?

The good news is that if you qualified for Cost Sharing Reduction Subsidies on a Silver plan (meaning you had a lower deductible or out of pocket maximum) you do not have to pay those dollars back.

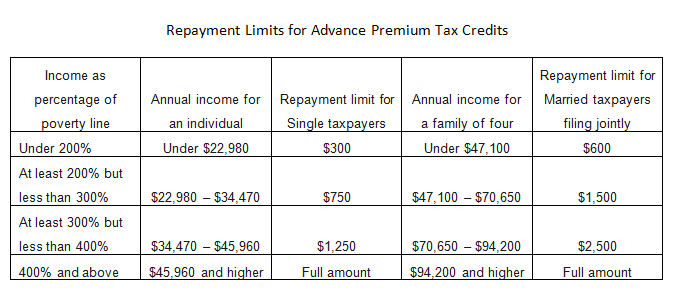

But, if you earned more than you estimated or took money out of a retirement account which raised your taxable income you could end up having to repay some or all of the money used to lower your monthly premiums up to the limit for your income level. (See chart below.)

If you want to avoid this, make sure to double check your application and report changes to income throughout the year so your credits can be adjusted. For those who are unsure what their income will be, consider using only part of the tax credit upfront or report your income a little bit higher to be safe.

If your income is lower that you estimated you will receive the difference as a credit in your taxes and it will be added to your refund. So, you will get the money to help pay for the insurance whether you decide to have it sent each month directly to the insurance company or in one lump some in your income tax refund.

What Are the Advanced Tax Credit Repayment Limits?

Line 28. Repayment Limitation. The amount is limited to certain amounts insuring you can’t owe more than you can afford if you received too many Advanced Premium Tax Credits.

Please note that you may have to repay ALL tax credits you received if you make over 400% of the FPL ($12,140 for an individual and $25,100 for a family of four in 2019.)

If you make less than 100% of the FPL you will not have to repay any tax credits you received.

These figures are for plans held during 2018. They are subject to slight changes each year. The Advanced Tax Credit Repayment limit table above is from IRS form 8692.

Be aware | Income inconsistencies require backup paperwork such as recent pay stubs or prior tax returns.

Under current rules, you are required to provide documentation proving income in cases where you estimate having an income significantly lower than is indicated by electronic data sources, such as recent IRS data.

You will have to provide proof of income if:

- you estimate your income between 100 and 400 percent of the federal poverty line (FPL);

- the marketplace has data indicating income is below 100 percent FPL;

- the marketplace has not assessed that the consumer has income making them eligible for Medicaid or CHIP; and

- the income projected by the consumer exceeds the income reflected in the data available from electronic data sources by not less than 10 percent (or a threshold dollar amount).

If you cannot provide documentation demonstrating income above 100 percent FPL, the marketplace will discontinue your tax credits and cost-sharing reduction subsidies. This means you will pay the full cost your monthly premiums and and reduced deductibles or out-of-pocket maximum2 will return to the full amounts as well.

You can read more about your eligibility for Premiums tax credits here.